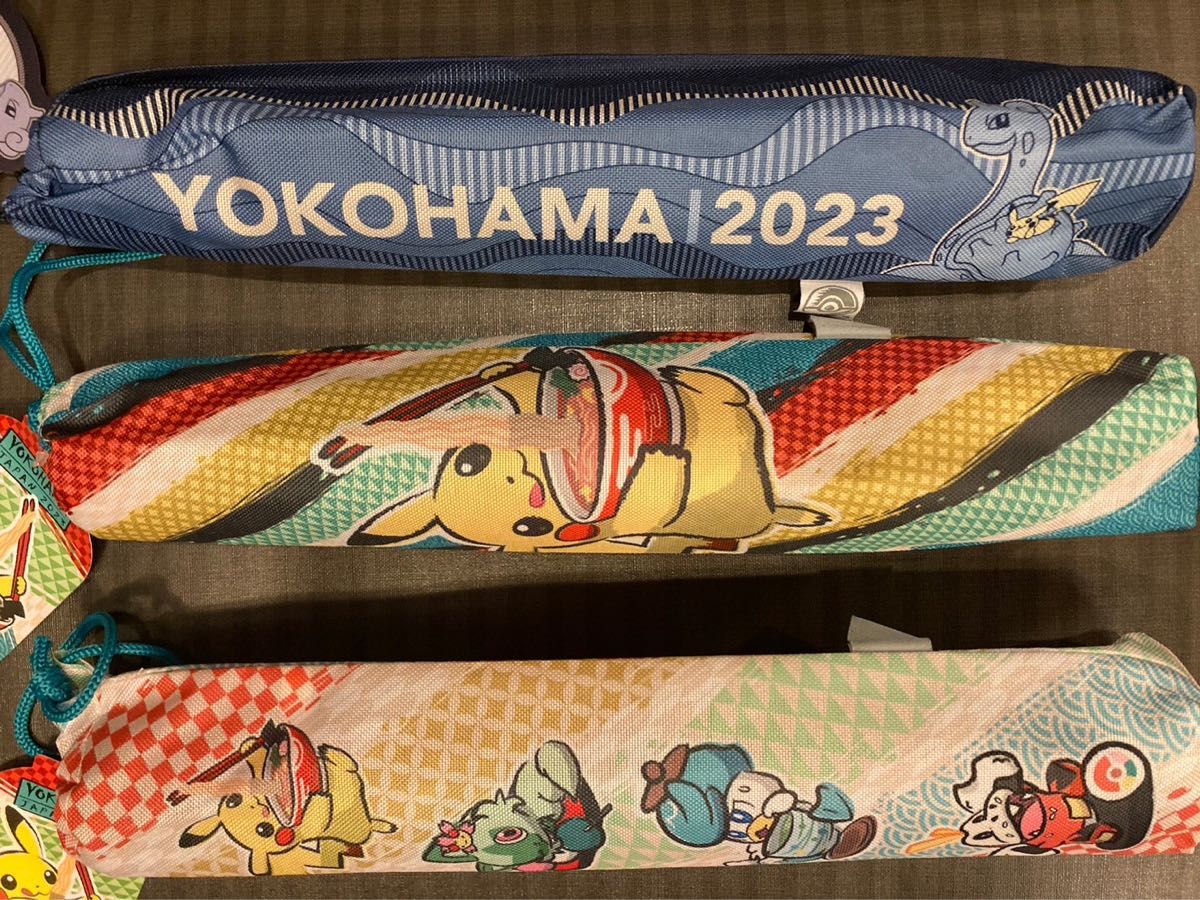

プレイマット3種類セット

(税込) 送料込み

商品の説明

ポケモンカード wcs 横浜 限定 ヨコハマ プレイマット 3種セット×1セットになります。即日発送いたします。

複数購入される場合はコメントにてお知らせください。

専用出品いたします。

単品でのご購入希望はご相談ください。商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > おもちゃ > キャラクターグッズ |

|---|---|

| 商品の状態 | 新品、未使用 |

ポケモンWCS限定 プレイマット3種類セット 春早割

wcsプレイマット 3種セット 入荷

品質は非常に良い ポケモンカード wcsヨコハマ 3種セット プレイマット

wcs2023 横浜 限定プレイマット 3種セット 新しいエルメス

再再販! ポケモンWCS2023 プレイマット3種、ダメカン2種セット

wcs2023限定 ポケモンカード wcsヨコハマ プレイマット 3種セット

wcs2023 横浜限定プレイマット 3種セット 【開店記念セール!】 8386円

Rakuten wcs2023 プレイマット 3種類セット - printwise.ie

WCS2023横浜限定プレイマット3種類\u0026デッキシールド3種類セット

☆日本の職人技☆ ポケモンWCS限定品 ラバープレイマット&バッグ3種

セールクリアランス wcs 横浜 プレイマット 3種セット おもちゃ

WCS2023ポケモン ラバープレイマット3種セット 【公式】 ポケモン

新品未開封品】ポケモンカードゲーム ラバープレイマット 3種類セット

WCS2023横浜 限定プレイマット3種類セット 未使用 | www

WCS2023限定 ポケモンカード プレイマット 3種セット ⑪ 充実の品 www

ホットセール プレイマット ガンダム バトスピ + 3種セット スリーブ

安い購入 ポケモンセンターワールドストア 2023 プレイマット3種類

ポケモンカードWCS2023 記念品プレイマット 3種セット 注目の福袋

Amazon | WCS2023 会場限定 プレイマット3種セット | アニメ・萌え

wcs2023限定 ポケモンカード wcsヨコハマ プレイマット 3種セット 今

ポケモン ラバープレイマット&バッグ3種セット 手頃価格 おもちゃ

70%OFF】 WCS2023横浜ラバープレイマット3種セットポケモン kochmetal

70%OFF】 wcs2023限定 ポケモンカード wcsヨコハマ プレイマット 3種

選ぶなら 4セット 新品未使用 wcs 限定 ポケモンカード プレイマット 3

未使用 WCS ポケモン プレマ プレイマット 3種セット 各2 | 4-sure.nl

WCS 2023 限定 ポケモンカード ヨコハマ プレイマット 3種セット 横浜

安値 ポケモンWCS プレイマット 3種類セット kochmetal.com.br

人気ショップ wcsプレイマット 3種セット ポケモン ポケモンカード

67%OFF!】 ポケモンセンターワールドストア 2023 プレイマット3種類

日本未入荷 Wcs プレイマット 3種セット ポケモン キャラクターグッズ

ポケモンカード wcs 横浜 ヨコハマ 3種 セット ラバープレイマット

ポケモンカードwcs2023横浜記念 プレイマット3種セット+デッキシールド

人気大割引 wcs2023限定 ポケモンカード WCS 横浜 プレイマット 3種

Amazon.co.jp: wcs2023横浜限定プレイマット3種セット : おもちゃ

WCS2023 横浜 ラバープレイマット 3種セット ポケモン WCS 人気商品

超可爱 新品未開封】ラバープレイマット&バッグ 3種セット ポケモン

ポケモンwcs2023 横浜限定プレイマット 3種セット|PayPayフリマ

ポケモン - ポケモンカード wcs ヨコハマ ラバープレイマット 3種

爆買い! ポケモンカード wcsヨコハマ ダメカン プレイマット 3種

WCS2023 横浜【ラバープレイマット】3種セット ポケモン 大特価 40.0

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています